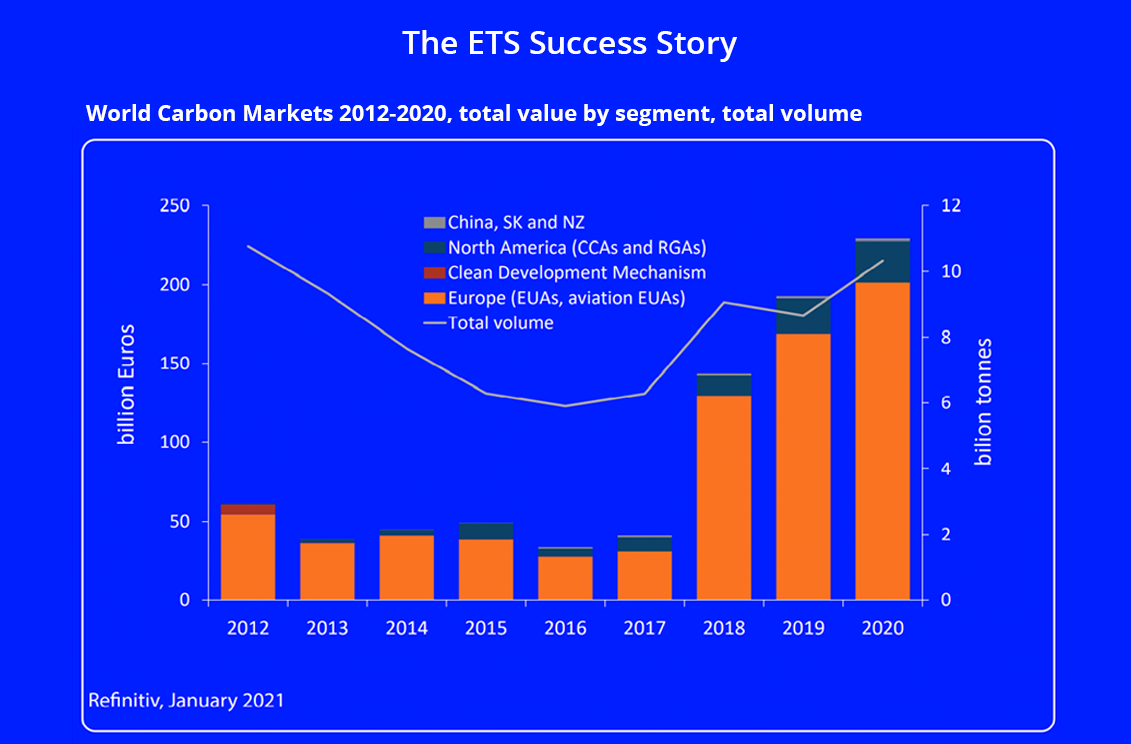

The world is emitting 35 Billion Tonnes of CO2 annually – 55BT if including other Green House Gases (GHG). Amidst the dire apocalyptic climate projections, it is pleasing to see just how successfully the ETS scheme in Europe contributed to reducing the annual coal-related CO2 power generation output by 280MT. Given the recent three-fold increase in the ETS price, this rate of reduction should continue a pace.

Accordia’s Ruby data system offers data management and trading utility in the newly emerging voluntary carbon markets. Responding to requests from a leading asset management group, Ruby is the first software system to cater to the unique requirements of this rapidly evolving market niche. This note lays out the basics of the market and provides two ways to profit from the trend.

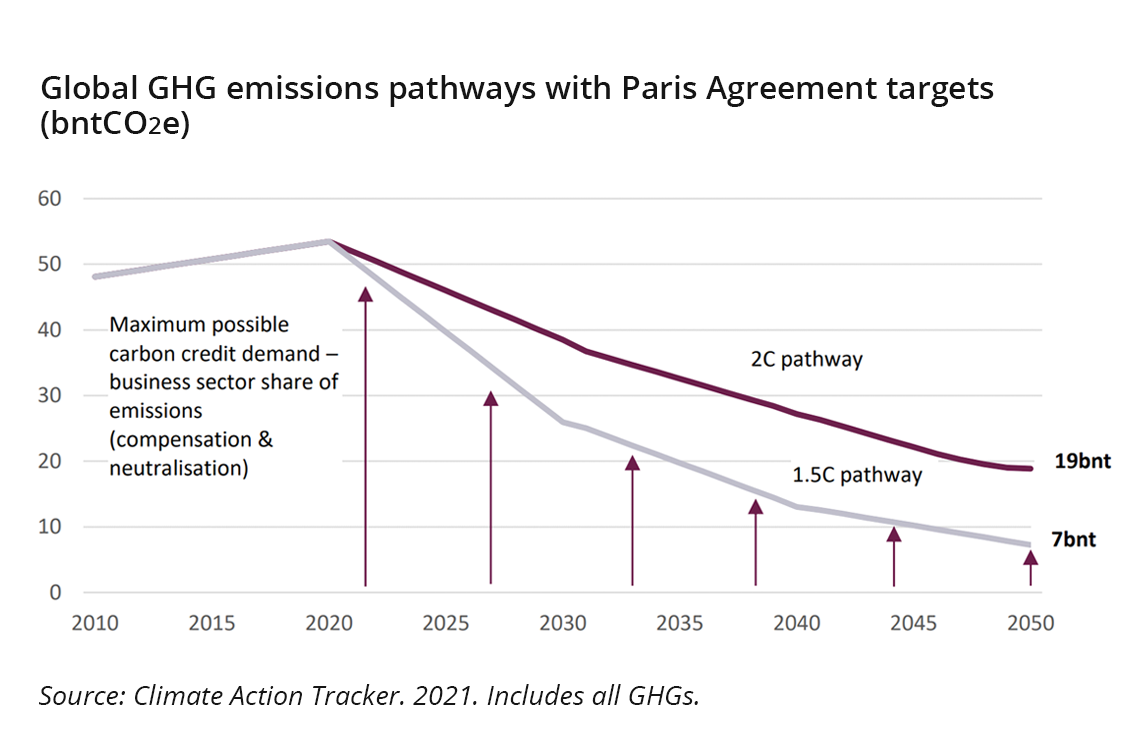

There remains a daunting challenge to reduce GHG emission levels in 2050 to 19BT, adequate to achieve the 2deg Celcius warming level or 7BT for the more optimistic 1.5deg Celcius.

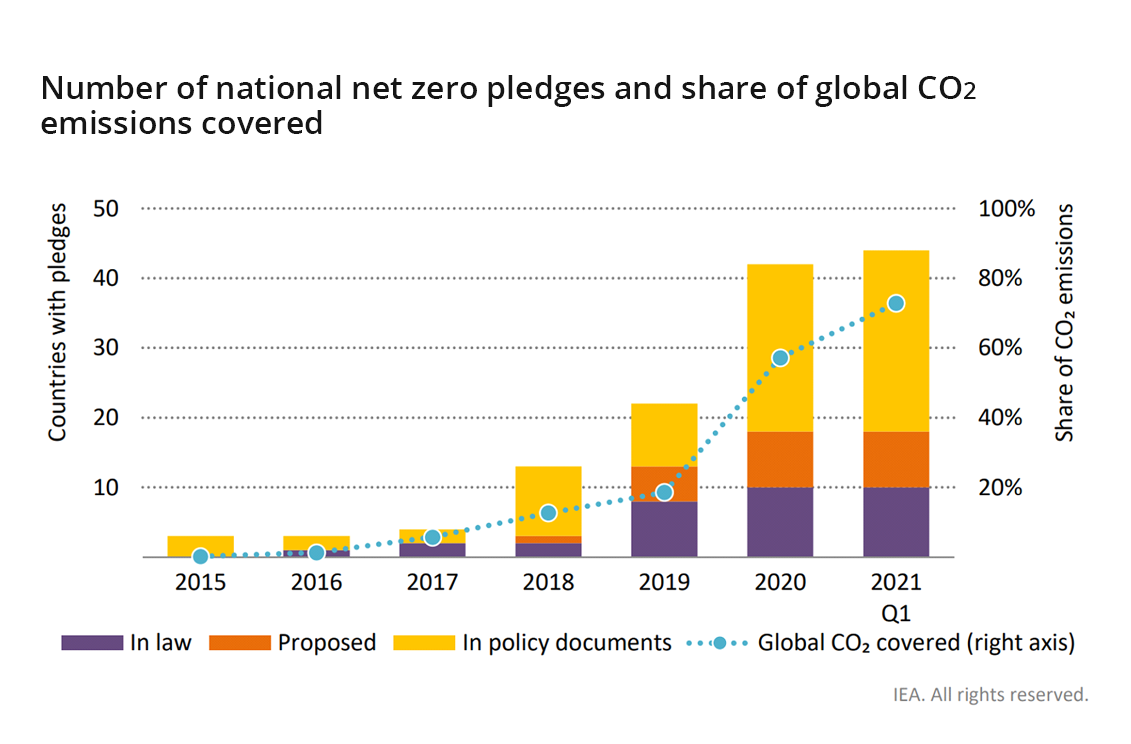

There has been an acceleration in net zero emissions pledges from many governments. In addition, over 5000 global corporations have established carbon reduction targets, which as of Q2 2021, 368 had a full net-zero target.

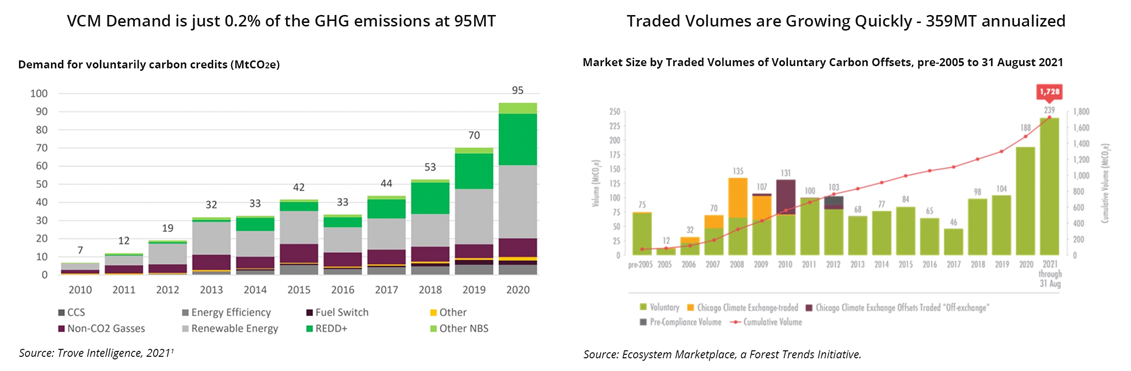

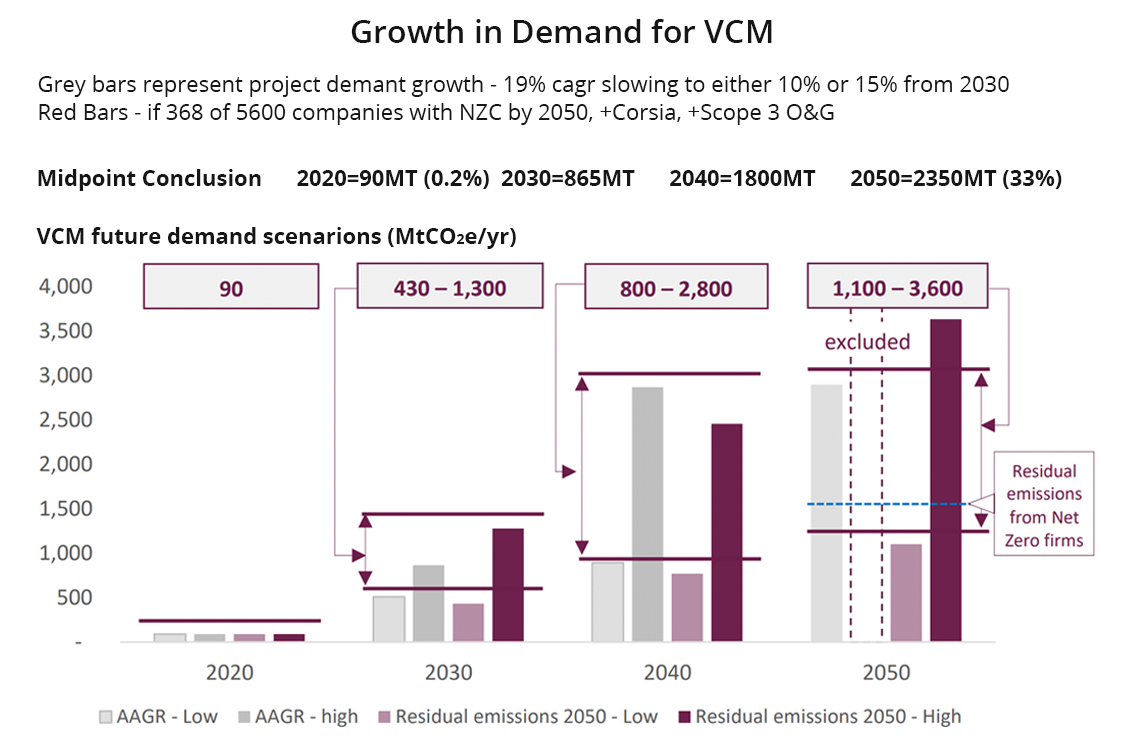

It should be noted, the significant contribution that may emerge from the unregulated voluntary carbon markets (VCM). Trove Research recently released a detailed study of the supply demand outlook for the VCM market. According to Eco Systems Market place, VCM demand was just 90MT in 2020 although traded volumes are running at more than twice this level.

Trove estimates variable growth scenarios which infer these markets could readily reach a mid-point annual volume estimate of 2.35BT by 2050.

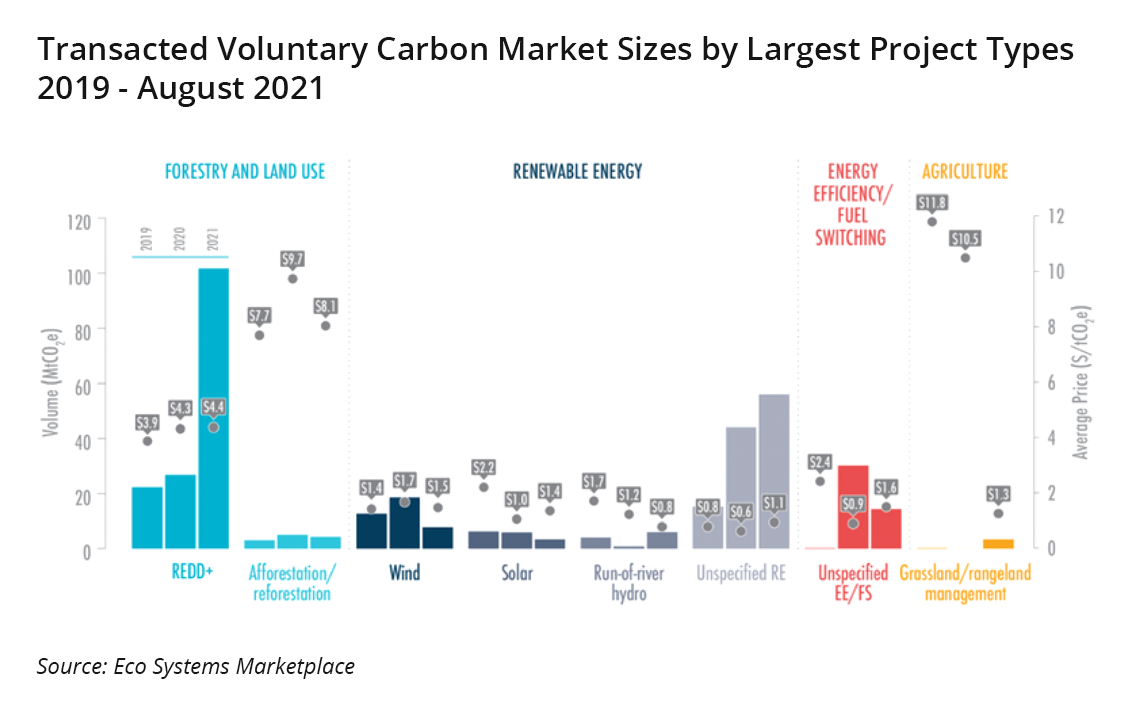

VCM carbon offsets are generated from a range of projects around the world and evaluated by four major carbon registries. They currently trade in a range of $1/T to $12/T, largely dependent on the type of project, its vintage, and its overall “additionality”, the industry’s measure of effective carbon reduction.

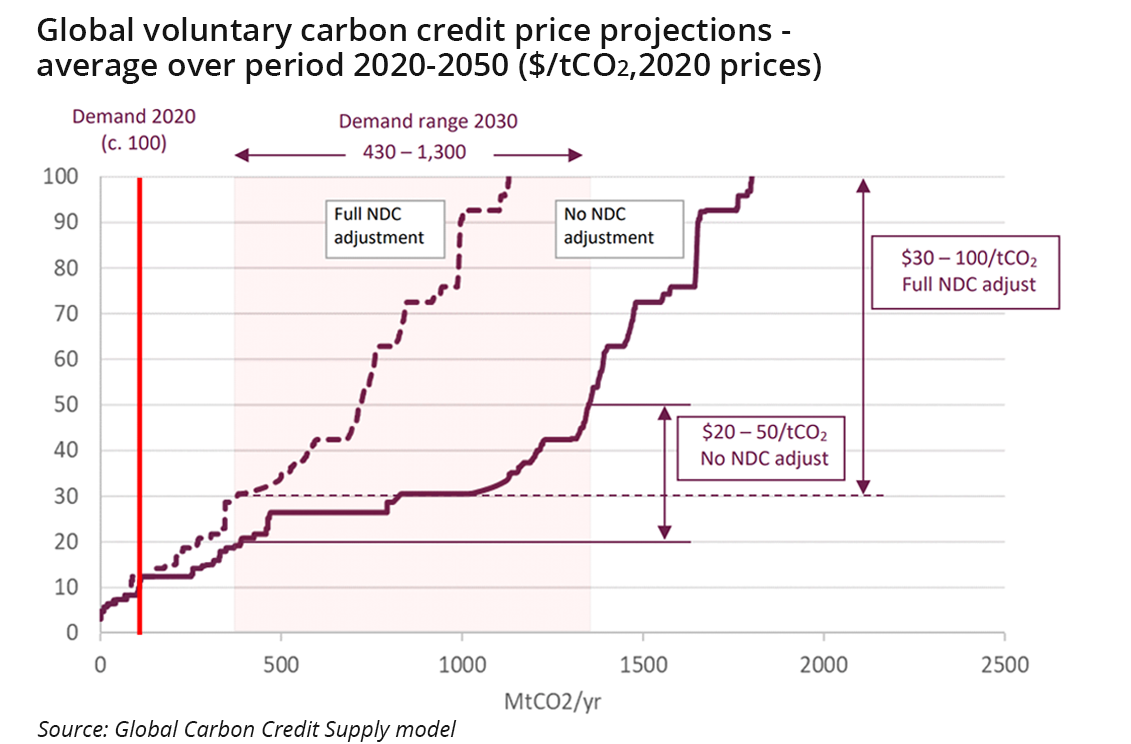

Those projects that can achieve the largest carbon reduction while adding to maximum Social Development Goals, for the lowest price, are undertaken first as they are considered to be at the bottom of the cost curve. There are some complexities and unknowns including the impact of already announced Nationally Determined Contributions (NDC’s), and how their treatment may impact the value of the offset. Trove generated costs curves for all types of projects under different NDC treatment. The conclusion should be that current average prices of $3.13 in 2021 are set to rise materially higher as demand for offsets starts to emerge.

Regulated carbon markets are well developed with efficient futures pricing. Voluntary markets on the contrary remain early in their evolution. Offsets are not fungible and the market is driven by OTC negotiated transactions.

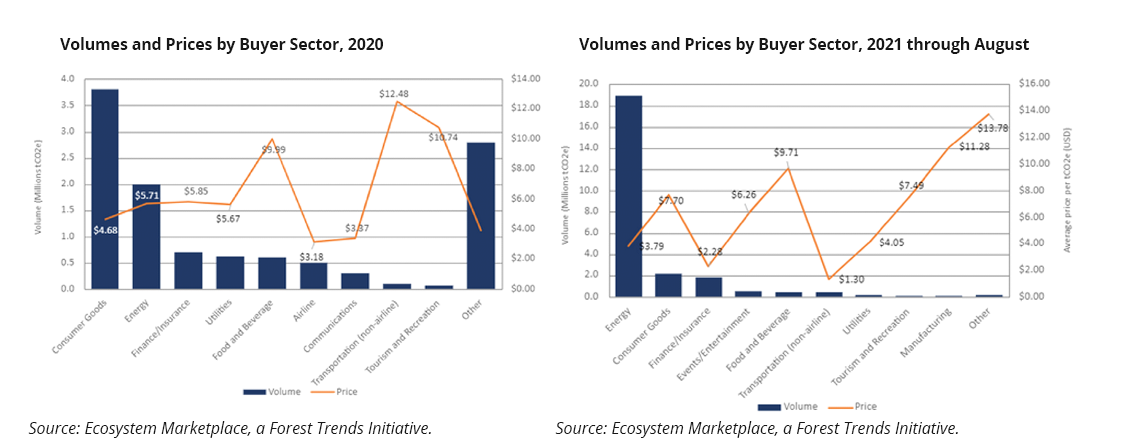

The Oil and Gas industry, now enjoying a renaissance in profitability, has emerged as a massive participant in the market, both as the project sponsor and offset buyer. Global Liquified Natural Gas (LNG) cargoes are now being actively marketed as net-zero, which currently costs on average around $4M per cargo to purchase the offsets. Consumer products companies are quickly moving to offer similar net-zero products, such as net-zero beer cans offered by aluminum producers. The movement is in many ways akin to the premium associated with organic food, and may prove a sustainable trend, especially to more climate-aware younger generations.

At Decarbonization Blind Spot it is our objective to highlight opportunities to profit.

We would like to highlight two opportunities worthy of attention:

Through the work of Accordia’s Ruby software platform, we have built research and trading software tools for one of the VCM industry’s leading asset management firms. The group is currently in fund raising mode, launching a fund to sponsor the development of competitive carbon offset projects, seeking capital appreciation as demand for higher- quality credits emerges (please reach out for details).

NFT Collectible Animals are coming to the carbon offset space where participants can purchase NFTs of endangered animals and a high percentage of the proceeds will flow to the carbon offset markets and associated charities supporting habitats of endangered species. The capital appreciation of similar collectible NFTs with unique artwork and other characteristics have been spectacular. While early versions of these Carbon NFTs rely on artwork and the generally frothy NFT marketplace, as fractionization of carbon offsets emerge, say to perhaps offset an Uber ride, the opportunities for this type of Carbon Offset Tokenization are massive.

Please reach out to us at Accordia-Group for details on this Carbon Tokenization and Fractionalization Platform.