Accordia Group’s Ruby to be featured on Family Office Association Podcast Interview with Evolution Environmental’s Andrew Ertel and Benedikt Von Butler

Andrew Ertel and Benedikt Von Butler recently joined Angelo Robles of the Family Office Association and David Talbot, Head of Ruby business development to discuss their recently launched Premium Carbon Offset Fund.

Andrew draws from his experiences in the earliest days of NOX and SOX markets, to provide a unique perspective on how voluntary carbon markets have emerged into the institutional landscape.

Benedikt describes the key drivers of supply demand, variable asset quality and diversification benefits which lead Andy to conclude the price outlook for these assets may lead to excess returns over time.

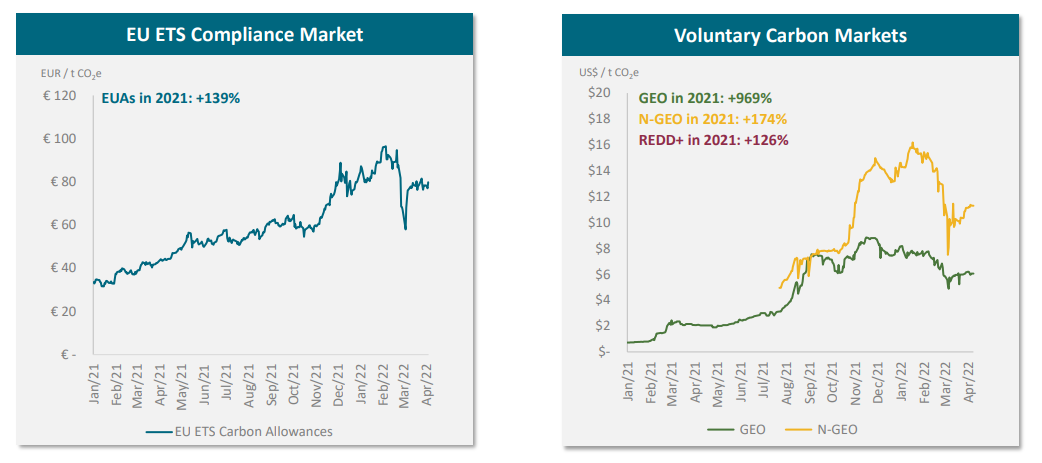

Source – ClearBlue Markets, EEAM

Both regulated and voluntary nature based carbon offsets have seen strong price appreciation, particularly leading into last year’s COP 26 follow up to the Paris Accord.

Andrew highlights how over 4000 of the world’s largest corporations have moved to adopt climate related objectives. Benedikt describes the wide ranging characteristics of voluntary carbon credits, and how the team adopts data intensive technology to rank the quality of the offsets with up to 40 separate factors, using the Accordia Ruby platform.

For further information visit www.eeam.com

Or email davidt@accordia-group.com